2024: The Year of the Seller’s Market (and Everyone Else’s Stress)

Inventory: More, Then Less, Then… Who Knows?

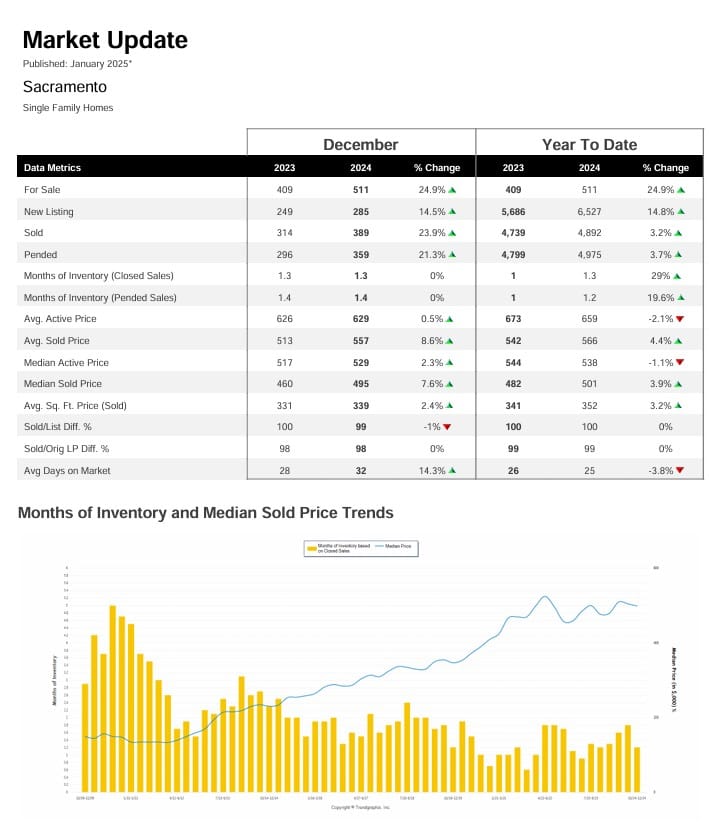

December listings surged 24.9% year-over-year, giving buyers a rare moment of joy as they scrolled Zillow at midnight. But before anyone could shout, “Open house!”, inventory plummeted 29.2% from November. It’s as if the housing market played a game of peek-a-boo with eager buyers.

Sales Activity: Buyers Stayed Busy

Closed sales in December climbed 23.9% year-over-year and 5.4% month-over-month. Buyers seemed to think, “Why wait for 2025 when we can start the year broke but with new keys in hand?”

Price Trends: A Mixed Bag

Median Sold Price: Up 1.2% month-over-month.

Average Sold Price per Square Foot: Down 5.8% from November.

Perhaps buyers hunted for deals—or decided a wine rack beats a full-blown wine cellar when the wine comes in a box.

Days on Market: Taking Their Sweet Time

The Average Days on Market stretched to 32 days (up 14.3% year-over-year). While homes weren’t exactly lounging, they took their time reminding everyone that even in a Seller’s Market, buyers still like to “sleep on it.”

Interest Rates: 2024’s Party Pooper

If mortgage rates were a dinner guest, they’d be the one grumbling about the soup. Rates climbed, making buyers do serious math on their budgets—and let’s face it, no one enjoys figuring out how much every extra percentage point adds to a payment. Higher rates typically cool the market, but Sacramento said, “Hold my latte.” Limited inventory kept the party alive, even if buyers sipped their cappuccinos a little more cautiously.

New Construction: Building Hope for Buyers

While existing home inventory remained tight, new construction continued to rise, providing a glimmer of hope for buyers. Builders worked to meet demand, focusing on entry-level and mid-range homes to address affordability concerns.

Single-Family Starts: Up year-over-year as builders adapted to demand for energy-efficient, modern homes.

Challenges: Labor shortages and material costs still posed obstacles, but the steady pipeline of new homes helped ease some pressure.

If this trend continues, new construction could play a pivotal role in stabilizing the market in 2025, offering more options for buyers feeling squeezed by limited resale inventory.

2025: Crystal Ball Predictions (or Wild Guesses)

1. Interest Rates: Will They Chill Out?

If rates stabilize or drop, buyers might flood back, cash in hand. But if they rise further, expect more buyers to consider options like splitting a house with their entire extended family.

2. Inventory: More Homes, Please?

December’s inventory bump hints that sellers might be ready to cash in—or just cleaning out garages. New construction growth could also help balance the scales, particularly if builders ramp up affordable options.

3. Prices: A Reality Check?

With affordability stretched thinner than a first-time buyer’s down payment, price growth might slow or stabilize. Sellers, take note: gold-plated fixtures no longer guarantee a bidding war.

4. Market Balance: TBD

December’s 1.3 Months of Inventory still favors sellers, but if new construction and resale listings increase, 2025 could finally offer buyers some breathing room.

2024 Takeaways: A Market Full of Surprises

This year’s housing market felt like a rollercoaster—full of ups, downs, and more than a few people screaming, “Never again!” Sellers cashed in on tight inventory, while buyers battled rising rates and endless online searches to find their dream homes. Meanwhile, new construction provided a vital lifeline for buyers seeking modern options in a constrained market.

Closing Thoughts: Bring on 2025

Whether you’re buying, selling, or just scrolling for fun, 2025 promises more twists and turns. Here at Sactown Appraisals, we’re ready to guide you through it all—with a smile, some stats, and maybe a joke or two.

Here’s to a year of new real estate adventures—cheers!